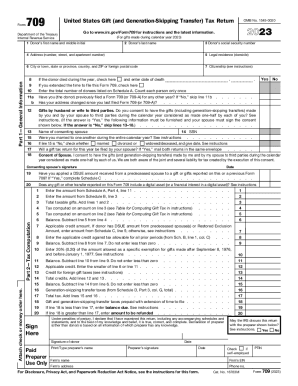

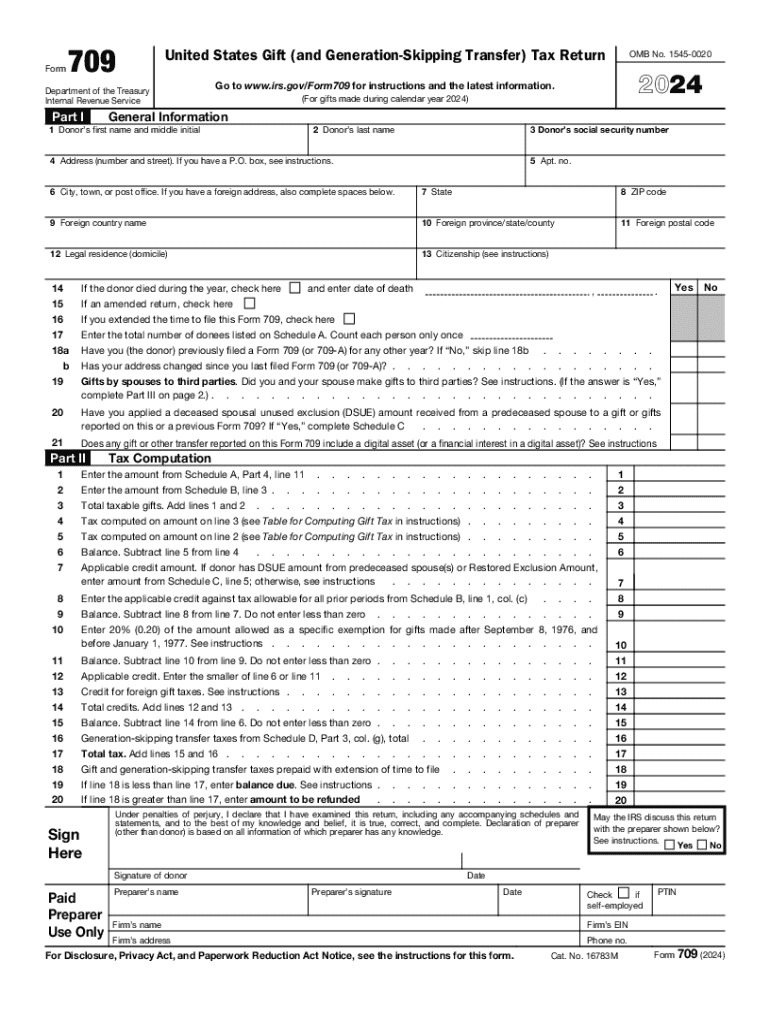

IRS 709 2024-2025 free printable template

Show details

Count each person only once Have you the donor previously filed a Form 709 or 709-A for any other year If No skip line 18b. Has your address changed since you last filed Form 709 or 709-A. b and enter date of death Gifts by spouses to third parties. Have you applied a deceased spousal unused exclusion DSUE amount received from a predeceased spouse to a gift or gifts reported on this or a previous Form 709 If Yes complete Schedule C. Cat. No. 16783M Form 709 2024 Page 2 Spouse s Consent on...

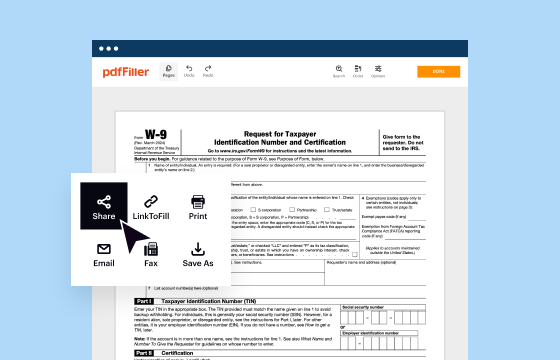

pdfFiller is not affiliated with IRS

Understanding and Effectively Utilizing IRS 709

Guidelines for Completing IRS 709

Instructions for Filling Out IRS 709

Understanding and Effectively Utilizing IRS 709

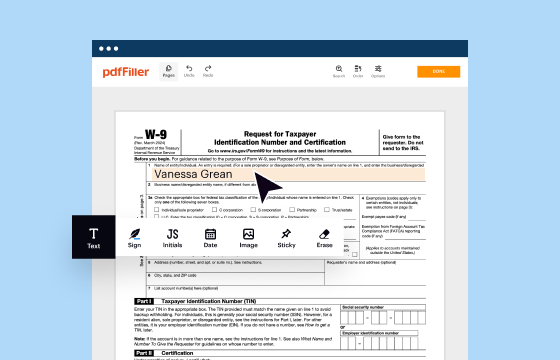

The IRS Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, plays a crucial role in estate planning and asset transfer. Understanding how to appropriately complete this form is essential for individuals making significant gifts during their lifetimes. This article will guide you through the complexities of IRS 709, ensuring clarity in both its purpose and the filing process.

Guidelines for Completing IRS 709

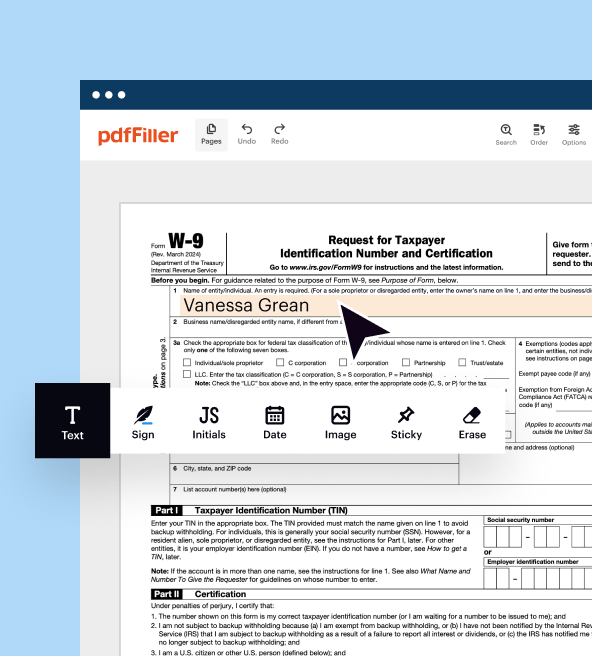

Successfully filing IRS 709 requires careful attention to detail. Follow these structured steps to ensure your return is accurately prepared:

01

Gather Necessary Documentation: Collect relevant financial records, including details about the gifts made during the year, their fair market values, and any prior year filings, if applicable.

02

Complete Personal Information: Fill out your name, address, and Social Security number, as well as the information for the recipient of the gifts.

03

Report the Gifts: Clearly list each gift made, providing details such as the recipient's relationship, the date of the gift, and its value.

04

Claim Exemptions: If applicable, indicate any exclusions or exemptions that apply, such as the annual gift exclusion amount.

05

Calculate Tax Liability: If your total gifts exceed the exclusion threshold, calculate the applicable tax using the IRS tax tables.

06

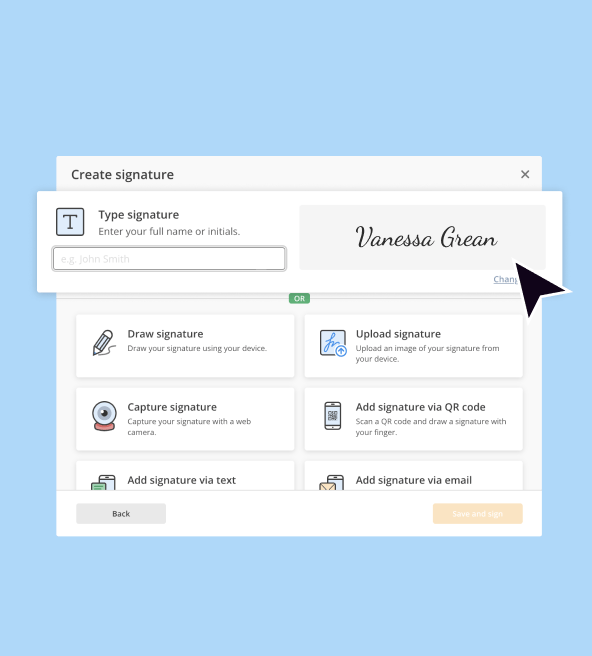

Sign and Date the Form: Ensure that you sign and date the form before submission to validate your return.

Instructions for Filling Out IRS 709

To effectively fill out IRS 709, adhere to the following instructions:

01

Use black or blue ink to ensure the form is legible.

02

Enter the recipient's details precisely as recorded, avoiding any alterations to names or addresses.

03

Include all related taxable gifts made throughout the year, noting any specific exemption limits.

04

Double-check calculations for accuracy, particularly in tax liabilities related to cumulative gifts exceeding established federal thresholds.

05

Review your completed form for completeness before submitting it to prevent delays or potential penalties.

Show more

Show less

Recent Updates and Modifications to IRS 709

Recent Updates and Modifications to IRS 709

It's important to stay informed about recent changes to IRS 709 that could affect your filing:

01

The annual gift exclusion has increased to $16,000 for 2022 and $17,000 for 2023, reflecting adjustments for inflation.

02

Changes in the exemption amount for the lifetime exclusion have also been implemented, now available up to $12.06 million in 2022 and $12.92 million in 2023.

03

Form simplifications have been introduced to improve user experience, allowing electronic filing for more users starting in the 2023 tax year.

Essential Insights on IRS 709: Purpose and Usage

What is IRS 709?

What Functions Does IRS 709 Serve?

Who Is Required to File IRS 709?

When Does the Exemption Apply?

What Are the Key Components of IRS 709?

Submission Deadlines for IRS 709

Comparative Analysis: IRS 709 and Other Tax Forms

Transactions Covered by IRS 709

Required Copies for Submission of IRS 709

Consequences of Failing to Submit IRS 709

Crucial Information Needed for Filing IRS 709

Forms that May Accompany IRS 709

Where to Submit IRS 709

Essential Insights on IRS 709: Purpose and Usage

What is IRS 709?

IRS 709 is the form utilized for reporting gifts made during the tax year. It is a critical component of proper tax planning for individuals who wish to minimize their tax liability upon death through strategic gifting while staying compliant with IRS regulations.

What Functions Does IRS 709 Serve?

The primary purpose of IRS 709 is to report gifts that exceed the annual exclusion limit. It also serves to track cumulative lifetime gifts against the lifetime exemption, ensuring accurate tax liabilities are calculated and reported.

Who Is Required to File IRS 709?

Any individual who makes gifts in excess of the annual exclusion amount must file IRS 709. Additionally, individuals transferring assets under specific circumstances, such as those involving generation-skipping transfers, must also submit this form.

When Does the Exemption Apply?

The exemption applies under the following conditions:

01

Gifts made to recipients who qualify for the annual exclusion, such as family members or friends, where the gift value does not exceed the set threshold.

02

Transferring educational or medical expenses directly to institutions if payments are made directly rather than as gifts.

03

Transfers to spouses or charitable organizations may also be exempt from taxation altogether.

What Are the Key Components of IRS 709?

IRS 709 consists of several parts including:

01

Page 1: Personal information and recipient details.

02

Part 1: Reporting all gifts made and their appreciating values.

03

Part 2: Exemption claims and calculations required for tax liabilities.

04

Schedule A: A comprehensive list of gifted properties and their valuations.

Submission Deadlines for IRS 709

The submission deadline for IRS 709 typically aligns with your individual tax return due date, which is generally April 15. If you need additional time, you can apply for an extension, granting you until October 15 to file, but note that any owed taxes must still be paid by the original deadline.

Comparative Analysis: IRS 709 and Other Tax Forms

IRS 709 differs from related forms like IRS Form 706, which is the Estate Tax Return. Form 709 focuses solely on gift taxation during an individual’s lifetime, while Form 706 is filed after a person's death to calculate the estate tax owed on their total assets.

Transactions Covered by IRS 709

IRS 709 covers various transactions, including:

01

Monetary gifts exceeding the exempt threshold.

02

Transfers of property, such as real estate or stocks.

03

Generation-skipping transfers, which involve gifts to grandchildren or unrelated beneficiaries.

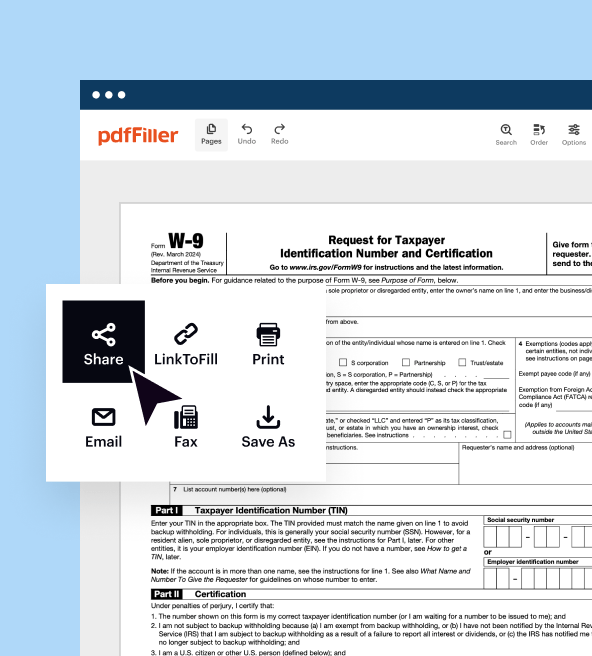

Required Copies for Submission of IRS 709

Ensure you retain copies of your completed Form 709 for your records, and submit one copy to the IRS. If you are sharing the gifts with more than one recipient, remember to adjust the number of submitted copies accordingly, especially if it involves future documentation or audits.

Consequences of Failing to Submit IRS 709

Failure to file IRS 709 can result in severe penalties, including:

01

Financial Penalties: Starting at 5% of the unpaid tax amount for every month overdue, up to 25% total.

02

Interest Accrual: Interest on unpaid taxes can accumulate quickly, adding financial strain.

03

Legal Consequences: Failing to file may trigger an IRS audit, which may complicate your overall financial standing.

Crucial Information Needed for Filing IRS 709

Gather the following essential information to complete IRS 709:

01

Your personal identification details, including Social Security numbers.

02

Detailed records of gifts made, including value and dates.

03

Exemption claims and supporting documentation for any exemptions or exclusions claimed.

Forms that May Accompany IRS 709

Depending on your unique circumstances and transactions, you may need to submit additional forms such as:

01

Form 709-B for special valuation under specific situations.

02

Form 8879 for e-filing, if applicable.

Where to Submit IRS 709

IRS 709 must be submitted to the address specified in the form's instructions, usually designated to the appropriate IRS service center based on your location. Verify the submission address each year to ensure compliance with current IRS guidelines.

In summary, IRS 709 is a critical form for accurately reporting gifts and managing tax obligations. Understanding the intricacies of filling it out correctly and the implications of non-compliance not only protects you from unnecessary penalties but also helps you optimize your estate planning strategies. Should you need assistance, considering tax planning professionals or resources such as pdfFiller can help streamline the process. Start your journey towards compliance and effective asset management today.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Very user friendly and efficient. Great product.

Really good programme. Much appreciated.

Try Risk Free